Speech: How we fund Australia's roads - Sydney Institute

Introduction

A few weeks ago I had the chance to ride in a Tesla Model S – and it was a very impressive experience.

These $125,000 electric vehicles are becoming a more common sight; Tesla recently opened a showroom at Martin Place, its third in Australia.

Today electric vehicles make up only around half a per cent of the vehicle fleet in Australia; but on some projections within twenty years they could comprise up to 30 per cent.[1]

For environmental and other reasons, many would say that is an unambiguously good thing. But there is a serious complication in this story.

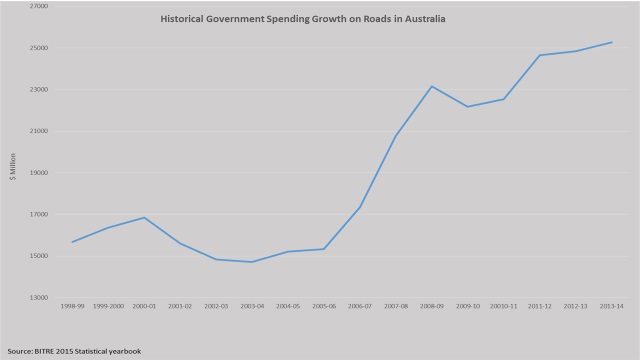

A car is not much use without a road to drive on – and roads are extremely expensive to build, maintain and operate. Across Australia we spend about $25 billion[2] each year on our roads – that is over $1,400 per year per vehicle.[3]

Of that, the federal government provides the largest contribution of all jurisdictions – funded largely from fuel excise, the 39.6 cent a litre tax which raises around $10.8 billion each year.

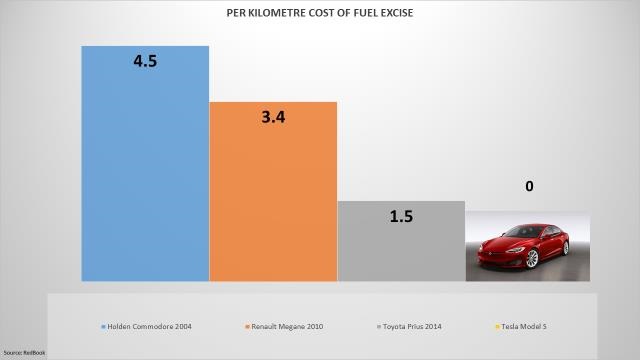

If you drive a twelve-year-old Holden Commodore, on a typical tank of fuel you will drive around 650 kilometres – so you will be paying around 4.5 cents a kilometre towards the cost of our roads through fuel excise.

If you drive a 2010 Renault Megane, which is considerably more fuel efficient, you get more kilometres for every litre of fuel you buy.

Your effective charge per kilometre works out to about 3.5 cents a kilometre.

If you drive a hybrid petrol-electric vehicle such as a Toyota Prius, you use much less fuel – so you pay around 1.5 cents a kilometre.

And if you drive a Tesla Model S, how much do you pay towards the cost of our road system through fuel excise? Precisely nothing.

Now my point in explaining this is not to criticise Tesla drivers. They didn’t invent our present system for funding roads. Indeed, many Tesla drivers, like many other Australians, are likely to be unaware of exactly how our road funding system currently works.

Also, because of the high upfront cost of a Tesla, their owners pay the luxury car tax and also high state stamp duty – so they certainly do contribute to the cost of our roads.

But I cite the example of the Tesla to illustrate the theme of my remarks to the Sydney Institute this evening: there are some significant problems with our system for funding Australia’s roads – one being that as cars become more fuel efficient, and as electric vehicles become more common, fuel excise revenue will come under increasing pressure.

Tonight I want to start by describing our present system for building, operating and maintaining roads in Australia – and how we pay for that system.

Next I want to review what has been said about our present system and its problems, in a whole series of recent reviews and studies.

In the final section of my remarks, I will discuss the Turnbull Government’s agenda in this important area of transport and economic policy.

Our system for building, operating and maintaining roads in Australia

Let me start then with a description of our current road system.

In Australia we have around 880,000 kilometres of roads across the country.[4] Roughly two thirds of that total comprises dirt roads in country Australia.[5] Only about 250 kilometres – less than one thirtieth of one per cent – are toll roads.[6]

Our roads are built and maintained by two main groups of organisations. Each state and territory government has an agency responsible for this function: Department of Roads and Maritime Services in New South Wales, VicRoads in Victoria, Transport and Main Roads in Queensland and so on.

But these agencies are only responsible for the main arterial roads.

By distance, the bulk of Australia’s roads – almost 650,000 kilometres – are owned and maintained by the 550 local councils around Australia.

We do have a federal highway system : The Hume Highway, the Pacific Highway, and the Bruce Highway that form the ‘National Land Transport Network.’ These roads receive priority for federal funding, but then they are still owned, maintained and operated by state governments.

For example, there is a historic transformation of the Pacific Highway underway: by the end of the decade it will be a four lane highway all the way from Sydney to the Queensland border. (The stretch between the border and Brisbane is already at this standard.)

Given the national significance of this upgrade, to a road that links our largest and third largest cities, the Australian Government has committed $5.64 billion towards it. But it is the NSW Department of Road and Maritime Services which is designing the upgrades and awarding contracts to construction partners such as Leightons and Fulton Hogan.

Building and operating roads is a very expensive exercise. In 2014-15 NSW Roads and Maritime Services spent $1.5 billion maintaining roads and bridges across that state.[7] Its capital expenditure on major roads projects in that year was almost $2 billion (with around one billion of that on the Pacific Highway).[8] VicRoads spent $1.319 billion maintaining and operating roads and capital expenditure was $703 million.[9]

What’s more, the total national spending on roads has been rising steadily over the past twenty years.

Where then does this money come from? That depends on how you look at it. The most basic answer to the question is: from general taxation revenue of federal, state and local governments.

By this I mean that each year NSW RMS, or VicRoads, or other agencies around the country, are allocated a budget to spend on their tasks of building new roads and maintaining and operating existing roads.

That budget is funded out of the state’s tax revenues – both road related and general, supplemented by grant funding from the Commonwealth government and also by revenue streams from the small number of toll roads owned and operated by the state road agencies.

For example, in 2014-15 NSW Roads and Maritime Services revenue was around $5.5 billion; of that $1.9 billion came from state taxes on motor vehicles, $1.4 billion from the general state budget, $1.5 billion in grants from the federal government and around $800 million from revenue earned directly by RMS, for example drivers’ licence and motor vehicle registration charges.[10]

I want to highlight a key point here: the state government organisations which provide road services are fundamentally different in character to state government organisations which provide services such as water, sewerage and electricity.

Water and sewerage services are provided by government business enterprises. They charge their users for the provision of services and generate revenue; out of that revenue they fund capital upgrades and also carry out operations and maintenance.

The same is true of the electricity networks, where they remain in state government hands.

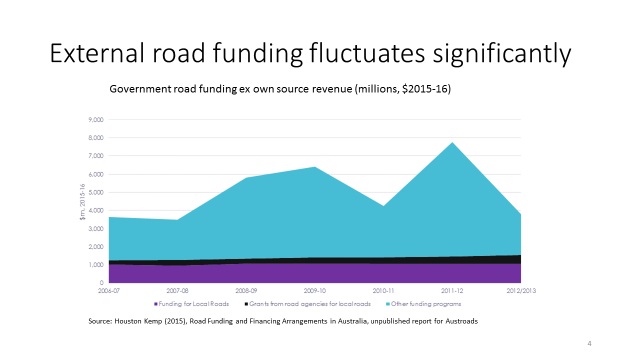

Roads, though, are different, because a state road agency does not have a revenue stream which comes directly from charges paid by users of the network of roads the agency builds, maintains and operates. Instead, it has a budget appropriation each year – and of course that appropriation can vary materially from year to year depending amongst other things on the vagaries of politics.

I have pointed out that road agencies do not receive a revenue stream; but certainly road users pay very significant charges and generate a lot of revenue. The point is that this goes into the consolidated revenue of governments – and then a share of it gets allocated to the road agencies of state governments, and to local councils.

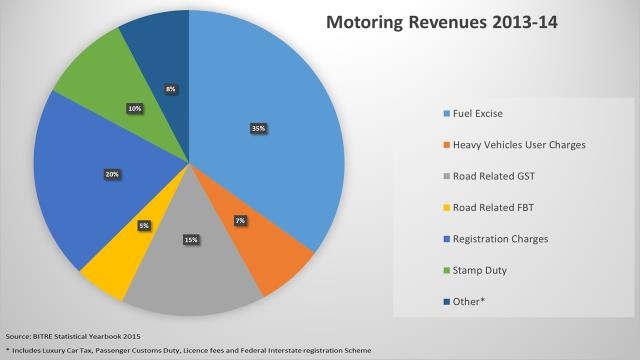

This chart sets out the main components of the charges paid by road users: fuel excise; user charges paid by heavy vehicles; registration charges; stamp duty; road related GST and other vehicle related charges.

Let me highlight an important point on this chart. There is a separate system for imposing on heavy vehicles - those above four and a half tonnes – specific charges for their use of the road.

A key reason we treat heavy vehicles separately is that they do much more damage to the road than light vehicles – in fact almost all of the maintenance costs are generated by the impact of semi-trailers which can weigh up to 45.5 tonnes and even larger vehicles such as B-doubles which can weigh up to 68 tonnes.[11]

However, the current heavy vehicle charging system is fairly rudimentary – and is generating increasing frustration from the heavy vehicle industry, principally because they cannot see much connection between the amounts they pay and the services they receive.

For example, the Australian Trucking Association recently criticised the system in these words:

The system should raise about $2.9 billion per year. The National Transport Commission (the agency which recommends charges) estimates that it will overcharge truck and bus operators by $190.3 million in 2015-16.

As an economic principle, user charges should reflect the cost of providing infrastructure – in this case, roads. Giving businesses a transparent signal about the cost of infrastructure gives them an incentive to use it efficiently.[12]

What people say about our present system

Over the past few years, there has been a striking number of reviews and studies of our current road funding system. A clear and common theme comes out of them: we have a problem.

In 2010 the Henry Review examined our current tax system. It concluded that ‘current road tax arrangements will not meet Australia’s future transport challenges’; that ‘existing institutions have not led to the most efficient use and supply of roads’; [13] and that our current system ‘raises revenue, but harms efficiency.’[14]

For example, Henry argued that our current user charging system for heavy vehicles does not efficiently price the costs of road wear caused by heavy vehicles. It recommended that governments:

should accelerate the development of mass-distance-location pricing for heavy vehicles, to ensure that heavy vehicles pay for their specific marginal road-wear costs.[15]

In 2014 the Productivity Commission reported on its study into the funding and financing of public infrastructure, observing the limits of the current system. The Commission argued that:

Current governance, taxation and institutional arrangements for the funding and provision of roads are presenting challenges for coherent long-term planning and investment in road infrastructure, and are ultimately unsustainable. There is no direct link from road-related revenue to road-related expenditure. This makes it difficult to determine road users’ preferences and willingness to pay for road infrastructure services.[16]

Last year the Turnbull Government received the report of the Harper Review into competition policy. The report observed that:

Roads are the least reformed of all infrastructure sectors, with institutional arrangements around funding and provision remaining much the same as they were 20 years ago. More effective institutional arrangements are needed to promote efficient investment in and usage of roads, and to put road transport on a similar footing with other infrastructure sectors. [17]

Infrastructure Australia commented on the same issue in the Australian Infrastructure Plan released last year. It argued that:

• The way we currently collect and distribute charges for using the road network is inefficient, unfair and unsustainable.

• Access and usage charges are opaque and blunt, bearing a very limited relationship to actual use of the road network.

• Once collected by governments, these charges are treated the same way as other taxation revenue, from which the government allocates funding to recurrent spending and specific priorities both within and outside of transport.[18]

Infrastructure Australia highlighted what it saw as the consequences in these arrangements:

• There are only limited links between use and charging, and leaves the connection between demand and supply to little more than the informed guesses of policy makers.

• cyclical funding and inefficient allocation means that we do not invest enough in maintaining and renewing our road networks, resulting in a ‘hidden deficit’ of maintenance liabilities and declining service standards.[19]

It is not just government reviews which have argued that there are significant problems with the current system.

In 2014 a number of motoring clubs joined with advocacy group Infrastructure Partnerships Australia to issue a paper entitled Road Pricing and Transport Infrastructure Funding: Reform Pathways for Australia. The paper described the complex flow of revenues back into the provision of roads:

Existing mechanisms for road revenue and investment see the majority of taxes collected flow through to Commonwealth and state consolidated revenue. The path for returning funds to road operations, maintenance and capital investment is complex and convoluted, heavily limiting taxpayers and consumers visibility of what proportion of, and where, revenue is deployed back into the network.[20]

The Australian Trucking Association the previous year, commissioned a paper from PWC, entitled A future strategy for road supply and charging in Australia. The paper concluded that:

A more transparent and efficient model for investment in roads and charging for their use is overdue.[21]

As well as voices from within the federal government and industry, we have also seen state government advocacy. For example, South Australian Premier Jay Wetherill recently had this to say in a speech to the National Press Club:

It’s getting harder for governments to meet the demands of road users from general taxation revenue, and roads remain a sector that relies heavily on taxpayers to fund new projects. I, therefore, propose that we establish a national heavy vehicle road-user charging system run by the Commonwealth in which State-based registration and Federal based fuel-excise charges are replaced by a charging system based on mass, distance and location.[22]

The Turnbull Government’s agenda

If there is widespread agreement that our current system for funding roads faces some significant challenges, what then is the Turnbull Government doing about it?

There is a concise summary of our agenda in the response the Government gave in November last year to the Harper Review into Australia’s Competition Policy. The Government said that it would:

accelerate work with states and territories on heavy vehicle road reform and investigate the benefits, costs and potential next steps of options to introduce cost reflective road pricing for all vehicles.[23]

Importantly, it is not just the Commonwealth government which has agreed to pursue this reform path. The Council of Australian Governments in December 2015 committed to develop a new competition reform agreement, drawing on the Harper Competition Policy Review.

Let me highlight an important point. There are two separate strands of work – at very different stages of development.

The Turnbull Government has committed to accelerate work on heavy vehicle road reform – that is, changes to the arrangements which apply for vehicles which weigh more than 4.5 tonnes. To be clear, this represents around 550,000 vehicles – of the 18 million vehicles presently on Australia’s roads. [24]

When it comes to the arrangements which apply to the great majority of vehicles, our commitment is to investigate the benefits and potential next steps of a road pricing system and whether they would outweigh the costs. That is a very different thing to making decision to proceed with such a system – and there are many issues that we would need to understand much better, and be fully satisfied about, before we would even contemplate such a change.

Let me give a little more detail on our planned reform approach in relation to heavy vehicles – before I then turn to talk about the investigations we want to make in relation to the vast majority of the Australian vehicle fleet.

The heavy vehicle work is being led by Australia’s Commonwealth and state and territory transport and roads Ministers, working collaboratively. Together we form what is known as the Transport and Infrastructure Council.

In January, the Council released two important sets of documents concerning Australia’s key freight routes. These are roads like the Pacific Highway, the Bruce Highway, the Hume Highway and the Newell Highway: as this map shows, roads extensively used by heavy vehicles.

The first thing we released was national expenditure plans, which essentially set out the dollars planned to be spent on these roads until 2018-19[25]. Secondly, we released ‘asset registers’. These set out a description of the condition of each road, by 100 metre segment: they provide a public account of the quality of service on the freight routes, and the planned investments.

This is all part of developing what is known, in an unappetising piece of economic jargon, as a ‘forward looking cost base.’

I cited earlier there is no linkage at the moment between what road users pay today and what they get for the money. This is true for cars and utes – so called light vehicles – for the reasons I have explained.

But it is also true for heavy vehicles, even though we have a heavy vehicle user charging system in place today. The problem is that the charges today are calculated based on the past spending decisions of governments; the objective is to move to an approach where heavy vehicle charges are based on the lifecycle costs of delivering road services to the heavy vehicle industry.

The price that heavy vehicles pay should be derived by working out how much the road agencies need to spend, looking forward, to keep the roads to an agreed service standard.

But calculating a true forward looking cost base is a complex job and we need much better data than we have previously gathered – hence the work now under way.

Another key question in heavy vehicle road reform is establishing an independent price regulator – which would have the power to calculate the user charge for heavy vehicles in accordance with an agreed formula, drawing amongst other things on the forward looking cost base. This would be the same job that the ACCC, for example, does today in markets like telecommunications and energy.

Under current arrangements, that decision still sits with Ministers, and furthermore it occurs based on past costs, as already outlined, with no reference to future investments, and therefore no ability to calculate a forward looking charge.

Over the first few months of this year I have held round table discussions in several cities with stakeholders in the heavy vehicle industry, exploring some of these issues. That has given me useful feedback about what the industry wants to see – and some of their concerns.

Let me turn now to why the Turnbull Government has said that we will ‘investigate the benefits, costs and potential next steps of options to introduce cost reflective road pricing for all vehicles.’

What we do know, as has been found by the many reports and studies I cited earlier in this speech, is that we have a problem with our current road funding system. It is complicated and far from transparent; it is inequitable; if fuel excise revenues decline as looks likely it may become unsustainable; and we are not making maintenance and investment decisions which best respond to demand.

What we do not yet know is whether a cost reflective road pricing system would do a better job.

There is a lot of work to do on understanding the impacts road pricing would have on all users of the road system and the broader economy. Before taking a decision in this area, we would need to be satisfied that the benefits from a broader use of road pricing would exceed the costs.

We would need to be satisfied that the outcome would be a fairer system; reduced congestion; and better roads.

We would also need to make the case to the community – where, frankly, there is understandable scepticism.

Let me give an example. Earlier this year, I did a radio interview on Sydney radio station 2GB, where I talked about the way we fund roads today. Following the interview, the host invited listeners to call in with their thoughts. Caller after caller expressed alarm at the notion of paying a per kilometre charge, using terms such as ‘cash grab’ and ‘new tax’.

Clearly any new system would need to be built on the principle that the total amount being collected was not increasing – that is, if road costs were recovered through user charges, then there were offsetting reductions in fuel excise and state taxes. I will repeat this – under a new system we would need to proceed on the principle that the total amount being collected was not increasing.

This is precisely what the Harper Review recommended: any introduction of direct road pricing should be accompanied by reductions of indirect charges and taxes on road users.

Part of the issue here is that most Australians have very little awareness of how they pay for roads today. According to research from the Australian Automobile Association, nearly one third of Australians do not know that the fuel price they pay at the pump includes a fuel excise charge of nearly forty cents a litre, and another 42% know about fuel excise, but do not know what the rate is.[26]

In the 2014 paper from Infrastructure Partnerships Australia and the motoring clubs I cited earlier – there is some interesting analysis of what Australians are paying today to use roads.

Looking at three scenarios – people living in different locations, driving different distances, and using different cars – Deloittes found these typical Australians were paying between $15 and $50 a week in road use charges. Also, the longer the distances people travelled, the bigger the fuel excise was a share of their total user charge.[27]

The Turnbull Government is fully aware of the sensitivities around this topic and that there are currently more questions than there are answers. That is why, when the Prime Minister and I released the Infrastructure Australia 15 Year Plan in February, we said that if we were to go down the road pricing path for light vehicles it would be a ten to fifteen-year journey.

But we should be clear about one thing. This is not a debate about whether Australians should face a charge to drive on the roads – because they already do.

This is a debate about whether we could have a charging system which is clearer and more transparent than the one we have today – and whether such a system would make Australians better off.

In this term of government, when it comes to light vehicles, our focus will be on a program of work to better understand how a system might operate, and what its impact would be. We are particularly interested in what economists call the ‘distributional consequences.’

What are the impacts on country people, for example? On outer suburban residents? People who drive long distances? Or short distances?

How much do people in these different categories pay today? And how much would they pay under a new system – which of course would likely involve considering different possible system designs and modelling their cost impacts.

But there is much else we need to think about. What would the transition process to a new system be? What would be the respective roles for the federal, and state and territory, governments?

Clearly, any change in this area could only occur if there were agreement between the Commonwealth and state and territory governments. There was a preliminary discussion at last week’s meeting of the federal and state and territory transport Ministers.

In our communique following the meeting, we said that we:

noted the growing momentum for road charging and investment reform, including the Council of Australian Governments’ December 2015 directive that Council accelerate Heavy Vehicle Road Reform and investigate the benefits and costs of introducing user charging for all vehicles.[28]

The communique noted that our immediate priority was further development of the heavy vehicle user charging system, but we also intended to progress next steps, including further, more detailed consideration of potential costs and benefits of reform.[29]

One way to get a better understanding of how a different system of road charging could work would be through conducting user trials.

The South Australian Government is conducting a trial of the impact of a more direct heavy vehicle user charge on two case study routes. The results of this trial will be very helpful as we progress the heavy vehicle charging reforms I spoke of earlier. But I expect we may look for other trial opportunities.

Conclusion

Let me conclude by repeating the observation that I have made at a couple of points in this paper. The way that we fund Australia’s roads is not well understood at all by most Australians.

But when you do turn your mind to this issue – as I have been doing over the past few months since being handed Ministerial responsibility for it – you soon conclude that it has considerable economic and social importance.

Economic – because of the amount of money we spend on roads, and because of the importance of road transport as an input into such a large proportion of activity in our economy.

And social – because using our roads to get from one place to another is of fundamental importance to all of us and to the operation of our modern Australian society.

I have argued today that there are problems in way we fund our roads today – and significant opportunities from making some reforms in this area.

The immediate priority is the way that we charge heavy vehicle users – where we have decided to make a change to the current system. Of course there is a lot of work ahead of us in developing the detailed changes required and in consulting with stakeholders.

When it comes to the system for light vehicles, the government’s thinking is at a much more preliminary stage. We know there are problems with the current road funding system; whether a different system would work better is something that we think would be worth investigating.

There is plenty of work ahead before we can reach any conclusions from such an investigation.

But one thing is clear – our current road funding system has some significant problems, and doing nothing about those problems is unlikely to be an effective strategy for addressing them.

[1] CSIRO Future energy storage trends, An assessment of the economic viability, potential uptake and

impacts of electrical energy storage on the NEM 2015–2035, p. iv (by 2035 17% Battery EVs and 13% Plug-in Hybrid EVs)

[2] BITRE Australian Infrastructure Statistics 2015 – Total Public Sector spending 2013-14 -$25.2 Billion

[3] $25.2 Billion (Total Public Sector spending 2013-14)/17.7 Million (estimated vehicles registered in Australia - 2014 Survey of motor vehicle Use)

[4] Source: BITRE2015, Infrastructure Statistics Yearbook 2015, Table T 1.6

[5] Source: BITRE 2012, Infrastructure Statistics Yearbook 2012, Table T 1.4

[6] Source: BITRE estimate based on toll road operator data

[7] RMS 2014-15 Annual Report, p 4

[8] RMS 2014-15 Annual Report, Appendix 3, pp 43-46

[9] VicRoads 2014-15 Annual Report, p 23

[10] RMS 2014-15 Annual Report, p 11; all numbers are rounded to the nearest $100 million

[11] Source: National Heavy Vehicle Regulator 2016, National heavy mass and dimension limits fact sheet

[12] Australian Trucking Association, 2016-17 pre-budget submission, p 5.

[13] Henry Review, 2010, Volume 2, Detailed Analysis, pp 373-374

[14] Henry Review, 2010, Volume 2, Detailed Analysis, p 375

[15] Henry Review, 2010, Volume 2, Detailed Analysis, p 377, Recommendation 62

[16] Productivity Commission Report, Public Infrastructure, 2014, p 20.

[17] Competition Policy Review (Harper Review, 2015), p 38

[18] Infrastructure Australia, Australian Infrastructure Plan, 2015, p 77

[19 Infrastructure Australia, Australian Infrastructure Plan, 2015, p 77

[20] Infrastructure Partnerships Australia, AAA, NRMA, RACQ, RACV Report, ‘Road Pricing and Transport Infrastructure Funding: Reform Pathways for Australia’, 2014, p 19.

[21] PWC, Australian Trucking Association: A future strategy for road supply and charging in Australia, 2013, p 3

[22] Speech by the Hon Jay Weatherill MP, Premier of South Australia, at the National Press Club, 8 July 2015

[23] Ibid

[24] Source: ABS Motor Vehicle Census, 31 January 2016, Cat. No. 9309.0

[25] Source: Transport and Infrastructure Council, Key Freight Routes Road investment and expenditure plans

[26] Australian Automobile Association, Motoring and Mobility Report 2016, http://keepaustraliamoving.com/wp-content/uploads/2016/04/AAA_KAMP_web.pdf

[27] Infrastructure Partnerships Australia, AAA, NRMA, RACQ, RACV Report, ‘Road Pricing and Transport Infrastructure Funding: Reform Pathways for Australia’, 2014, p 56

[28] Transport and Infrastructure Council, Communique, 4 Aug 2016, http://transportinfrastructurecouncil.gov.au/ communique/

[29] Transport and Infrastructure Council, Communique, 4 Aug 2016, http://transportinfrastructurecouncil.gov.au/ communique/